Johns & Co

Innovative London estate agency JOHNS&CO approached Digital Ethos to gain more dominant rankings across London and build a strong organic growth strategy.

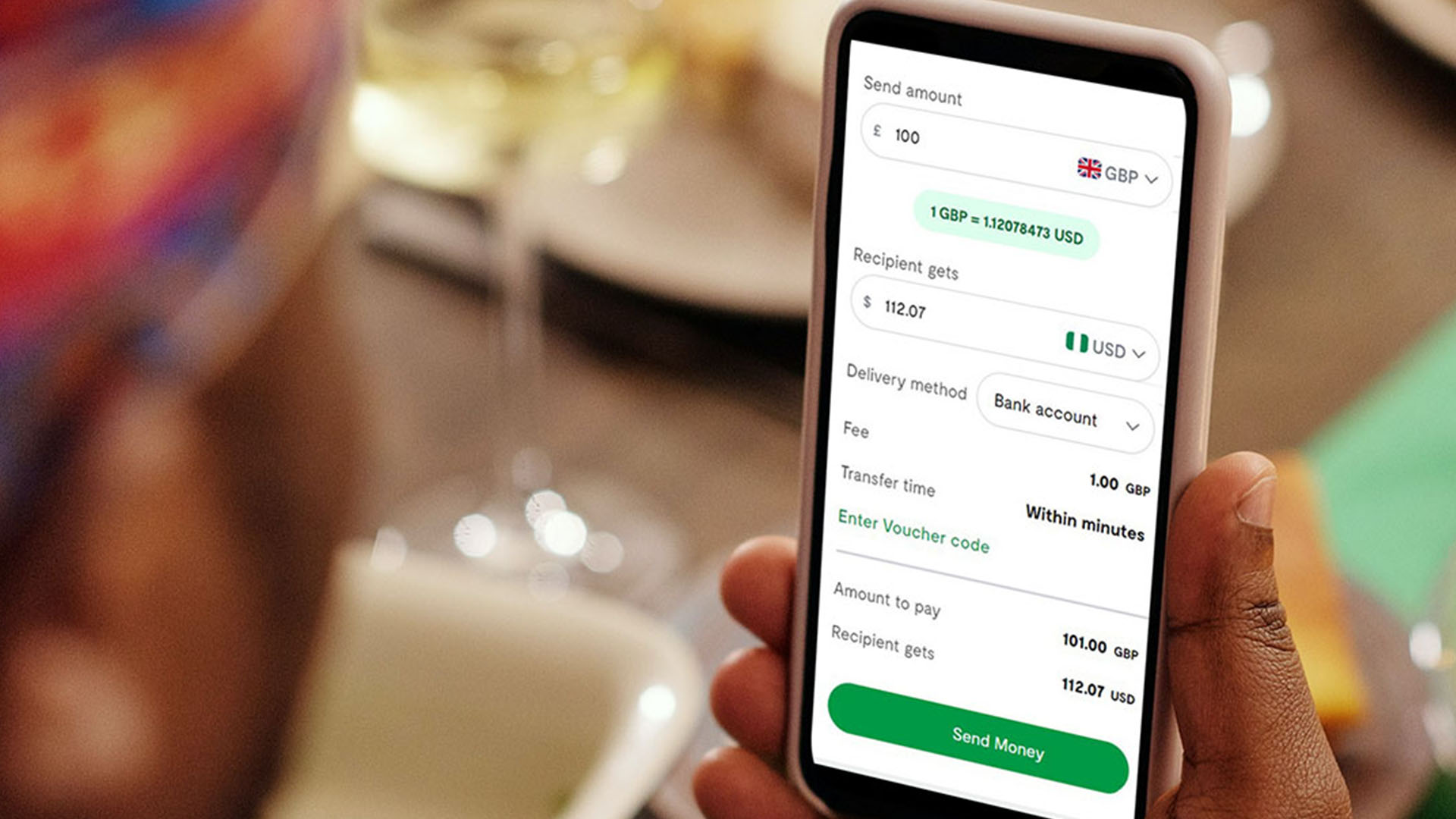

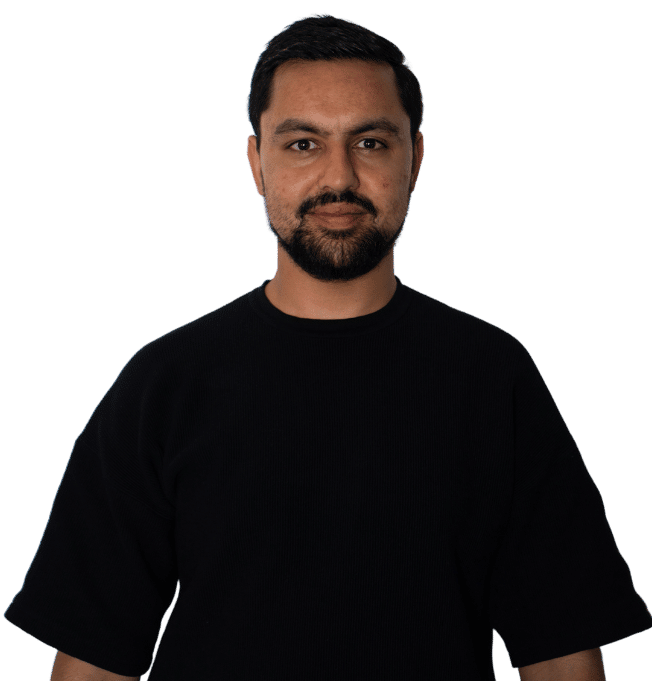

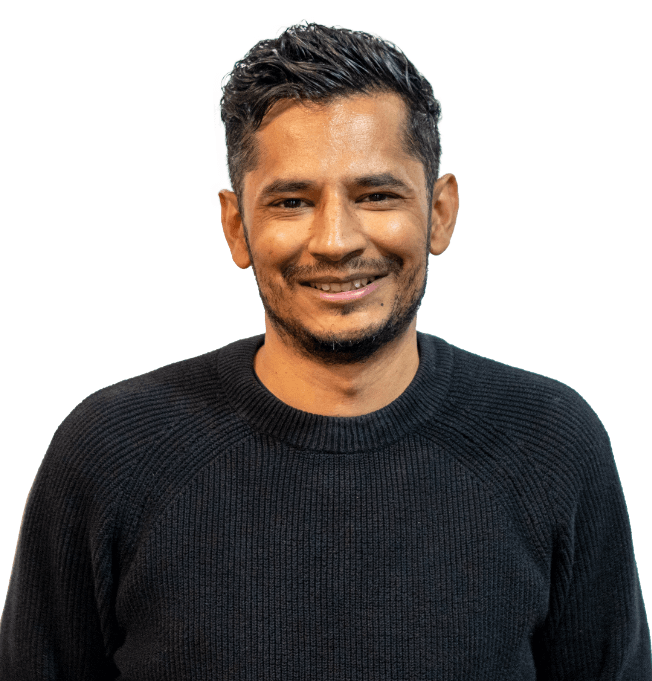

Flutterwave

As a new entrant to the market, Flutterwave came to Digital Ethos for support in gaining significant market share of the remittance sector. Learn more.

Samsung

Discover how we supported Samsung as they entered into the 8K TV Market.